Thoughts from Tony Jones, CEO One Nucleus.

On 22 May 2024 I had the pleasure to attend the launch of a Manchester Airport Group (MAG)/WPI Economics report entitled ‘Services Superpower’ at the House of Commons. Pictured opposite is MAG CEO Ken O’Toole setting out the key findings (photo courtesy of MAG).

On 22 May 2024 I had the pleasure to attend the launch of a Manchester Airport Group (MAG)/WPI Economics report entitled ‘Services Superpower’ at the House of Commons. Pictured opposite is MAG CEO Ken O’Toole setting out the key findings (photo courtesy of MAG).

As one may expect from its authors, the focus of the research behind the report was on how the aviation industry supports fast-growing sectors. Aviation may seem a bit left field for someone based in Life Sciences, but for me it triggered a number of thoughts about the positioning of the UK Life Sciences sector in such terms, but importantly also how it relates to other sectors, UK plc and indeed UK citizens as a whole.

An initial thought for me has not changed since I reported from our Breakfast Seminar at BIO Convention 2023. There I raised my feelings of discomfort about the terminology. I fully understand why ‘superpower’ is used to convey that sense of leadership, strength and ambition stakeholders wish to see. Superpower for me however conjures up a sense of conflict. Whether arms races or indeed Marvel movies, those in possession of superpowers compared to their peers seem to be associated with a sense of control and dominance. In the world of global medicine, I only see two superpowers – biomedical innovation and unmet patient need.

Watching a Marvel movie, perhaps naively, I am looking to the ‘goodies’ to collaborate and leverage their superpowers to defeat the ‘baddies’. If they don’t, well that could be depressing unless you are anticipating a comeback in a sequel. In addressing patients around the globe, I sort of feel the biomedicine innovators collaborating to defeat unmet need feels better than competing.

For sure, it isn’t that collaboration doesn’t happen of course: we see it day in and day out to huge effect, but in some of the national (or even regional) branding to look the best, I can’t help feeling the terminology can be seen by others as a challenge rather than an invitation and this can serve as a tool to deter collaboration between excellent clusters. Perhaps given there is minimal difference in letters between ‘Superpower’ and ‘Powerhouse’ would the latter not be a more attractive collaborative partner?

Enough of my soapboxing and back to the subject matter. The report highlighted some key facts and figures. These included statistics such as the UK effect of not enabling business travellers to traverse the globe would mean a drop of 0.98% in global GDP (or $1 trillion in 2024) due to the UK’s high ranking in the Global Outgoing Knowledge Index’; the UK is second only to the US as an exporter of services and is twice the OECD average; and ten focus sectors with a high reliance on international connectivity, including Life Sciences, are projected to grow faster than the economy as a whole over the next decade.

For me, the report highlighted how as an island nation, the UK increasingly exporting its excellence and knowledge, is absolutely vital to growth. It is equally vital to remember that such international connectivity can come at a cost to sustainability, employee wellbeing and more.

The proponents of travel are not divorced from such concerns if balanced with increasing productivity, wealth creation, and ultimately tax take for the government to enable support where needed for its population. The aviation industry, with its commitment to reaching Net Zero by 2050 via the Sustainable Aviation roadmap along with the cost has more incentive than most to decarbonise as quickly as possible.

The need to be internationally connected is nowhere more true than for Life Sciences I would argue. We observed phenomenal global collaboration during the battle against COVID-19, so we know it is effective in meeting health challenges. We have seen some very supportive policy developments by UK Government to support technology transfer, incentivising innovative research and development, and of course, pension reforms to free up capital to invest in the sector.

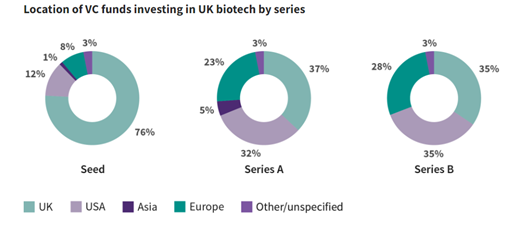

These things, rightly playing to well-established UK strengths create potential. If the UK Life Science sector is to scale-up to create economic benefits including job creation across the UK, then it seems clear that accessing international investment is going to be key. As set out by the BIA’s biotech financing report with Clarivate as UK-based biotech companies scale, increasing amounts of that investment are secured from the US, illustrated in that report as follows:

During the recent Boston Bootcamp, discussions focussed on aspects such as how UK companies can access investment from MA-based investors along with how they can access the ecosystem for collaborations and deal flow. We often see reports of the quantum of life science venture capital secured from international investors, as above, yet the Services Superpower report did make me wonder how, and more importantly, who, tracks the inward revenue streams secured by UK-based companies selling services in R&D. Along with the obvious providers such as CROs, CMOs and CDMOs, I would potentially include here the revenue generated by those in Professional Services providing legal, regulatory, and commercialisation advice where it is underpinned by the sector. I wasn’t able to uncover such data or reports as yet, so my search continues.

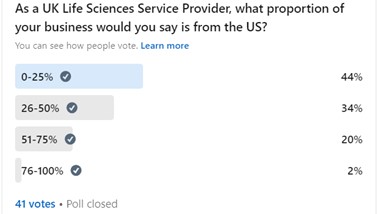

As a small step, I did place a simple poll on LinkedIn that just focussed on what proportion of some of our providers’ contracts arise from the US alone. The LinkedIn representation of the results from this small poll can be seen here. My feeling from this, along with a number of anecdotal discussions in recent weeks, is that whilst a quarter is most common now, this is changing in the direction of >25% quite quickly. Moreover, speaking directly with some of the companies growing their US customer base, the importance of senior executive (both corporate and research) travel to secure deals and build relationships was evident. Some are electing to open a physical presence to help drive the business, given the high people factor impact in dealmaking in this sector.

As a small step, I did place a simple poll on LinkedIn that just focussed on what proportion of some of our providers’ contracts arise from the US alone. The LinkedIn representation of the results from this small poll can be seen here. My feeling from this, along with a number of anecdotal discussions in recent weeks, is that whilst a quarter is most common now, this is changing in the direction of >25% quite quickly. Moreover, speaking directly with some of the companies growing their US customer base, the importance of senior executive (both corporate and research) travel to secure deals and build relationships was evident. Some are electing to open a physical presence to help drive the business, given the high people factor impact in dealmaking in this sector.

Life Sciences, along with Advanced Digital, Advanced Manufacturing and Fintech, was highlighted as one of the key emerging industry sectors with a high reliance on air connectivity and forms a key part of the aviation industry’s case to the government for support. I find myself therefore coming full circle to why I found the MAG/PWI report interesting.

My interest is driven by the mentioning by so many Life Science leaders of their need to generate investment, deals, or contracts from international markets whilst often in the same discussion, raising the challenges of connectivity to and gaining traction in other world-class ecosystems such as Massachusetts and California. Moreover, it is not just about business deals. The desire to have effective connectivity, regulation, and openness to attract senior Life Science executives to take roles in emerging UK-based companies also arises from many perspectives, including from UK business executives, US investors, and US-based senior executives wanting to spend time with UK companies.

With that in mind, and far from One Nucleus wanting to be a lobbying organisation or even me personally, I felt I should finish this thought piece with a wish list in this context that I feel I would like to see delivered going forward as follows:

- UK Government policy to support the aviation industry in bringing increased global connectivity to the UK ecosystems with the potential to scale with the input of overseas players. A direct Stansted – Boston route to encourage Cambridge-to-Cambridge deal flow for example.

- International research partners and investors should not under-value the high quality of UK innovation in many platform-style companies that operate more like a fee-for-service model than a venture backed biotech which is mainly down to the investment landscape.

- Immigration policy that reduces the barrier for experienced US-based industry leaders to locate in the UK for a period in order to enhance the validation of leadership teams in the eyes of key investors.

- Support of high-quality data collection and reporting of the contribution the R&D Services and Life Science Professional Services make to the UK economy, including generating tax take and employment of UK-educated scientists.

In conclusion, I felt there was little in the Service Superpower report, or indeed, the remarks made by the industry leaders and politicians at the launch event that I would find myself in disagreement. I do see the potential of our Life Sciences industry to be a key driver of future economic growth. I do agree that international connectivity to clusters like Greater Boston via aviation is key; people contact and movement are vital. Getting all the above right I feel will enable our industry to maximise its beneficial impact on patients globally.

In answering the question I posed in the title of this article, then I feel that if the superpower terminology is what achieves the end goal to motivate the above developments and deliver on my wish-list, then I can live with that. Is science the only one? Of course not. The UK has many strengths to take to the world and to be successful, it seems clear we need to be super at all of these activities, and they all need to work together effectively.

In answering the question I posed in the title of this article, then I feel that if the superpower terminology is what achieves the end goal to motivate the above developments and deliver on my wish-list, then I can live with that. Is science the only one? Of course not. The UK has many strengths to take to the world and to be successful, it seems clear we need to be super at all of these activities, and they all need to work together effectively.

At a time of political change, the challenge now lies perhaps with the lobby groups and policy influencers to help any future government get it right through aligning motivations, excellence, and regulation for the respective key stakeholders. Ultimately, if we collectively all do our part, then maybe a step-change in outcomes for patients and populations is within our grasp – the time is now!