by Alicia Gailliez, Business Development Manager, One Nucleus

Securing funding is always a top challenge for biotech companies. This blog will discuss how the uncertainty in the biotech funding landscape may be transforming into more positive tones as we see Nasdaq IPOs happening and private investment rounds returning. Amid this optimistic news, we celebrate some case studies of investment raised by One Nucleus members, highlighting some of the ways that One Nucleus helps to support our members to scale their innovation and businesses, often in a challenging environment.

The global biotech financing market faced some significant challenges in 2022, reflected across different sources of funding across all investment stages, as the record-breaking levels seen during COVID saw a correction:

Private Equity – In 2022, global Life Science companies secured 507 financing rounds totalling $20,360 million, a significant drop from the 697 rounds worth $39,237 million in 2021 (Biotechgate Life Science Financing Summary published January 2023).

IPOs - In 2021, 11 life science companies from the UK went public, while only 4 UK-based life science companies were listed on a stock exchange globally in 2022 (Biotechgate UK Life Science Trend Analysis 2023 published April).

Follow-on Financings – In 2022 Q1, follow-on offerings reached the lowest value since 2016 and the lowest number of transactions since 2012 (Clarivate, Biopharma deals in review: H1 2022).

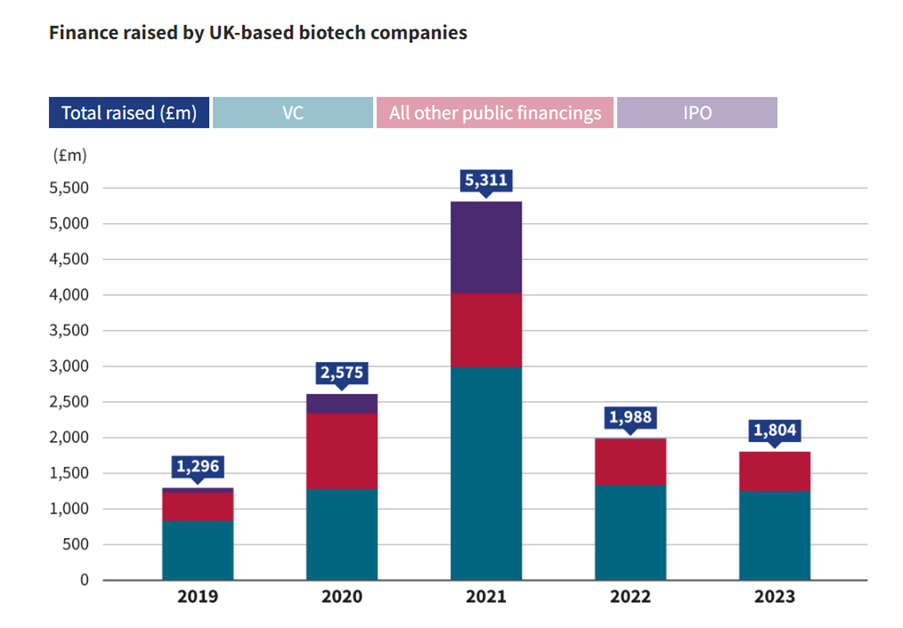

The chart below, taken from the BIA UK biotech financing 2023 report, indicates that this was against a remarkable high of 2021. The Clarivate Report on Biopharma deals in review: H1 2022 suggests a correction back to pre-pandemic levels.

Interestingly, a Labiotech article highlights that the ‘record-setting’ highs may have been caused by hype around emerging technologies that reached their peak during COVID-19, such as mRNA technology, which has since drawn to a natural halt, partly explaining the downturn in venture capital that followed.

The challenging funding landscape was undoubtedly influenced to some extent by turbulent economic factors, but headlines now indicate green shoots, including a bounce back in Biotech IPOs in 2024. According to BioPharma Dive data, nine companies went public in the first quarter of 2024 priced at more than $1.3 billion, which is more than three times the proceeds from biotech IPOs in the first quarter of the previous year.

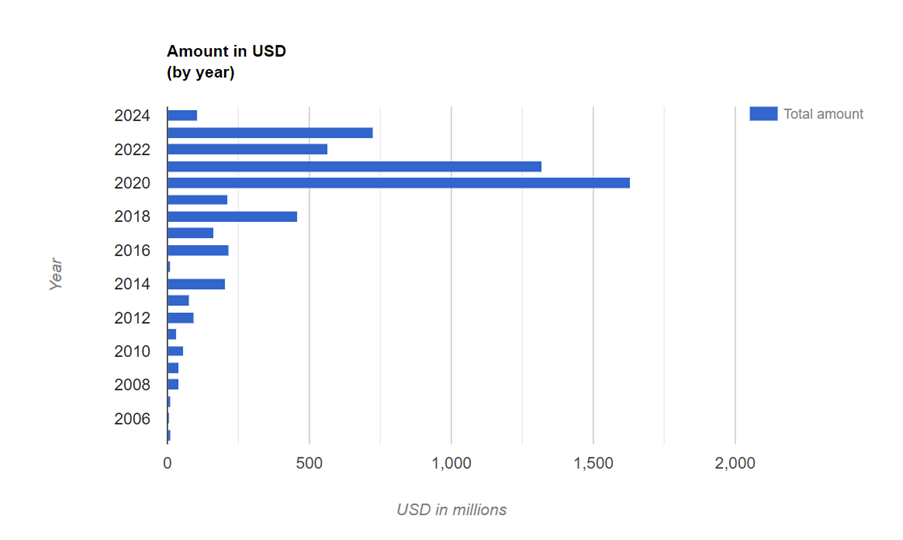

Statistics drawn from the Biotechgate database (as of 17 April 2024) for One Nucleus members also show positive signs, with the value of deals for 2023 surpassing that in 2022 by 28%. Interestingly, statistics show a consistent number of deals year on year between 2020 and 2023, suggesting that deals were ongoing while the value fluctuated. There have been a number of successful deals among members in the first quarter of this year to celebrate, including:

In January, Apollo Therapeutics announced a second close of Series C financing, raising an additional $33.5 million, bringing the total raised in the round to $260 million. Proceeds will be used to advance pipeline programmes through clinical development.

In March, Optimum Strategic Communications announced their client Mission Therapeutics had raised £25.2 million to progress clinical candidates in the area of mitophagy.

In April, a Biofidelity press release announced the company had successfully completed a financing round totalling $24 million, bringing the total funding raised since the company was founded in 2019 to $60 million. The funding will be used to drive the next phase of growth for the company and the adoption of their ASPYRE®-Lung test for the detection of biomarkers for non-small cell lung cancer (NSCLC).

Image: Biotechgate Database, capital raised by One Nucleus members as of 17 April 2024

One Nucleus supports a thriving, impactful, and diverse life science network. To support the growth of these companies requires interventions by way of technical, business, and strategic support to enable innovation, scalability, and success. The pie chart below shows the number of FTE (Full-Time Equivalent) employees at One Nucleus member companies. It is worth noting that almost half have 20 employees or fewer, reflecting the vibrancy of company creation in our ecosystem and how One Nucleus can support even the most nascent of new companies. Data drawn from the Biotechgate database illustrates that the most common therapeutic areas of One Nucleus members’ pipelines are oncology (37%), infectious disease (15%), neurology (11%), and metabolic diseases (7%).

One Nucleus supports a thriving, impactful, and diverse life science network. To support the growth of these companies requires interventions by way of technical, business, and strategic support to enable innovation, scalability, and success. The pie chart below shows the number of FTE (Full-Time Equivalent) employees at One Nucleus member companies. It is worth noting that almost half have 20 employees or fewer, reflecting the vibrancy of company creation in our ecosystem and how One Nucleus can support even the most nascent of new companies. Data drawn from the Biotechgate database illustrates that the most common therapeutic areas of One Nucleus members’ pipelines are oncology (37%), infectious disease (15%), neurology (11%), and metabolic diseases (7%).

Images: Biotechgate Database, Therapeutic area One Nucleus members, statistics as of 19 April 2024

Data from the same database, when looking at the stage of the drug development pipeline, reveals approximately three quarters of One Nucleus’ members are in the pre-clinical space, suggesting high levels of innovation in the membership, high quality investment opportunities for growth investors, and potential deal flow for large biotechs and Pharma seeking to bolster their pipelines. Through our various activities, One Nucleus helps companies to get the support that they need to research, develop, and scale their businesses.

One Nucleus’ portfolio of events and conferences create opportunities to connect with experts on a diverse range of topics, including those around dealmaking, accessing Government incentives or diligence in getting your house keeping in order to ensure deals are not lost. Take for example the Genesis 2023 panel ‘The Anatomy of a Great Dealmaker’ which discussed the key attributes of a great dealmaker, or the roundtable ‘Grants and Incentives: What’s available and how can cash benefits be accessed?’ held in collaboration with EY. A recent article by Tony Jones, CEO, One Nucleus summarises the Fringe session around Genesis 2023, hosted by Mathys & Squire entitled ‘The Good Housekeeping Guide to Dealmaking’ and highlights the critical factors to ensure a strong dealmaking strategy. All are examples showcasing the valuable peer-to-peer knowledge exchange facilitated by One Nucleus that can help our members to navigate a challenging funding landscape.

We also support our members with savings through a Group Purchasing Scheme and Member-to -Member Marketplace, as well as numerous discounts across third party conferences and member discounts on facilities management. Members can also access discounts on our training, events and profiling options.

With the excitement around investment and deal-making in ADCs as highlighted in a recent Fierce Biotech article discussing Roche's renewed interest, you do not want to miss out on our upcoming ON Helix conference on 4 July at Babraham Research Campus! Our opening session will explore the latest advancements and discussions surrounding new modalities in the biotech industry, such as the engineered antibody space, and the considerations to ensure translation of these emerging technologies to successful treatment modalities. Join us a full day of engaging keynote speakers, panel discussions and networking opportunities by registering for ON Helix today!