By Tony Jones, CEO, One Nucleus

It is not difficult to see how challenging recent times have been in raising capital for nascent life science companies no matter where they are located. There have always been regional differences in dynamics and financing cycles, but these have to some degree been overshadowed more recently, with almost every location seeing entrepreneurs and leadership teams struggle to secure capital, particularly at the early stages.

Data from the BIA

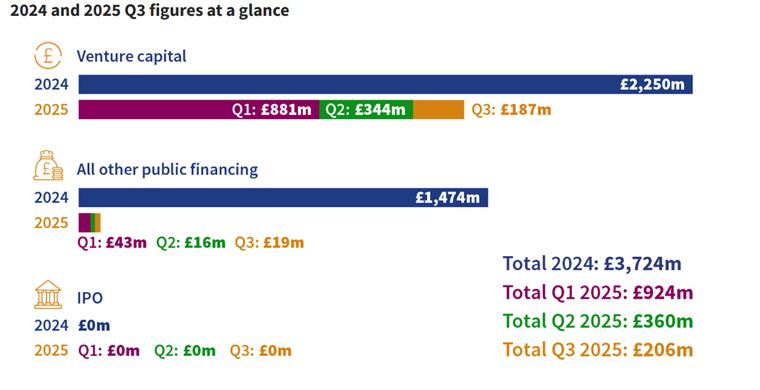

The latest BIA BioFinancing Report covering July-September 2025 did not necessarily offer much comfort, as one of the illustrations sets out here, particularly for early-stage companies who must now be thinking about plans for the upcoming partnering and investor conferences and which new investors to target when investing time and money to attend the large events.

An International Landscape

As economic forecasters often tell us, it is risky to base any predictions (or perhaps hopes) on narrow window data such as a quarter. That said, the last quarter has seen the first biotech IPOs on Nasdaq after quite a dearth, some very large M&D deals bringing capital back into the biotech system and generally some signs of encouragement that investment may be on the up at last. The above report mentions how US venture investment was approaching 20% up on the same period last year. Whilst feeling encouraged, there is a little note of caution however, given that similar Q3 sentiments have been expressed in previous years but were something of a false dawn.

Where is the money being placed?

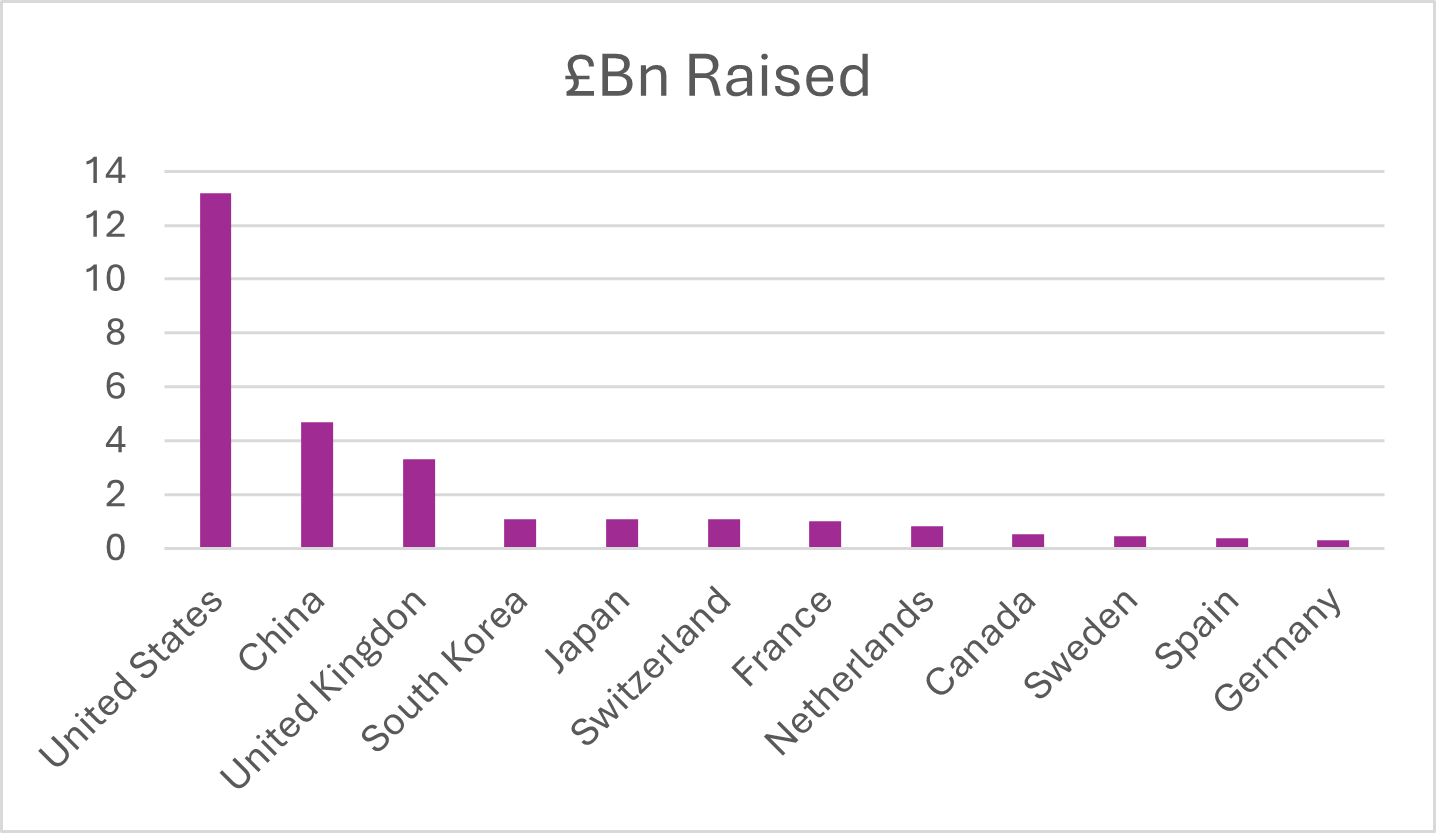

Taking a look at data on Pitchbook, between September 2024 and September 2025 it would suggest that of the money raised, the top twelve locations started with the United States, with China in second and then the United Kingdom as illustrated here. This rings true perhaps with the level of interest in, and activity by, China-based companies and investors engaging with the US and European companies.

How could Life Science Companies be rethinking global fundraising roadshows?

For any early-stage and growing company with limited management team bandwidth and cash runway, the challenge of targeting global investors, even compared to perhaps a more traditional transatlantic axis, must feel daunting. “But one has to follow the money” is a phrase that is often heard when this is raised. Equally, advice to start-ups and early-stage companies can be confusing. Finding the right balance between leveraging the local ecosystem and personal relationships locally at start-up whilst also being keen to engage a strong, ideally international syndicate ahead of anticipated re-financing can be difficult.

One observation of attending the RESI (Redefining Early Stage of Investment) conferences and collaborating with the LSN team of late, with a mix of in-person and online partnering, is that even early-stage capital appears to be both more mobile and more accessible to those starting out. In the One Nucleus goal to support members in accessing capital and seeking out new investment avenues to add to the repeated cycles of pitching to great local investors, engaging in partnership with LSN has felt a particularly good step forward. The format and spread of the RESI events across North America, Europe, Asia and now South America can provide a potential revolving door of investor contact, pitching and meetings at a global scale. Something One Nucleus feels is a platform One Nucleus members can leverage.

The LSN Impact

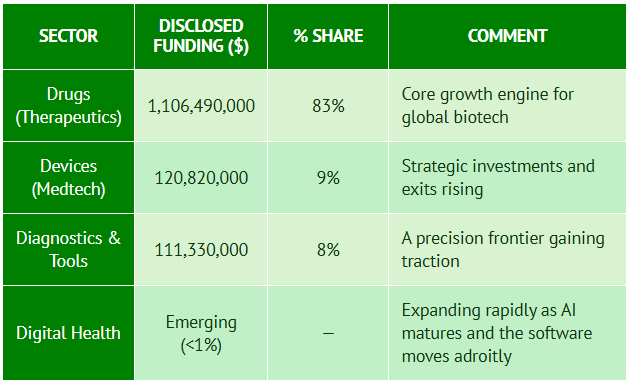

In penning this article to set out the drivers for One Nucleus to want to engage with LSN and RESI, it is timely that Dennis Ford, CEO of LSN, has recently published his analysis of the LSN Ecosystem Deal Matrix. Dennis took the opportunity to analyse the impact of how 90 companies that had touched the LSN Database-RESI-LSN Labs matrix having disclosed deals to delve into what the benefits have been and what has driven the deals. As an example of his findings, I include a table from the publication here which illustrates the cash raised across the drugs, devices, diagnostics and digital silos.

Whilst the $$ signs are larger in the drugs silo, it should be noted that all four areas have relatively similar deal numbers suggesting innovation, and appetite to invest in it is fairly evenly spread. After seeing $1.29Bn raised by 90 different companies from 52 different investors, the data suggests the coordinated data access – pitch readiness preparation – outreach via the RESI series is effective and efficient. A compelling reason why One Nucleus has felt building the relationship with LSN was a great thing to do to benefit our members.

Working as Partners

It is great news thta we have been able to build on the above alignment to now have LSN as a One Nucleus Partner, enabling member discounts, visibility and insights from the RESI series. Look out for the upcoming opportunities below and ask about the discounts and upgrade opportunities available.