by Tony Jones, CEO, One Nucleus

If there has been one topic that remains consistently high on the list of things that keep bio-entrepreneurs and their executive team colleagues awake at night, then raising finance and the investment climate is it. Of course, other factors are vital to success also, but the phrase ‘Cash is King’ is a cliché for a reason. This, particularly over an extended period such as the past two years or more when raising capital has been so challenging, compounded by world events, the phrase has never seemed more relevant. The lack of investment flowing across the biotech value chain is impacting not just the primary companies but also the services and supply chains that rely on them. Not to mention the people impact of staff teams being trimmed and ultimately innovative medicines not reaching patients.

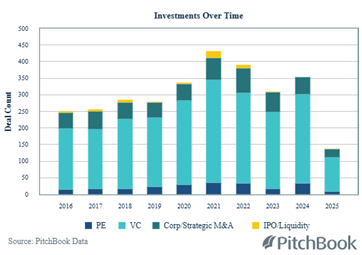

Taking a look at the data such as these from PitchBook illustrates very well how the investment deal count in the UK remains low, with <150 deals reported across all types in the first half of 2025. Private Equity and IPO transactions have all but been absent completely, whilst even M&A has been noticeably smaller compared to previous years.

Perhaps the low deal count is a little offset by the size of investments being made. There have been some eye-catching rounds secured, including by companies such as CellCentric and TrimTech, yet there are numerous, especially early-stage, companies finding it challenging to see where the next investment is coming from.

Supporting Our Members’ Fundraising and Dealmaking

Whilst One Nucleus has always sought to support our members across all business aspects, including securing investment and deals, deeper research into understanding the current challenges, behaviours and deal flow dynamics. Alongside successful engagements with commercial data providers, experts in membership, partners and collaborators, One Nucleus now feels well-placed to target support to those companies within membership seeking finance and deals. Now enabled, One Nucleus has created a new service offering pulling these threads together. The package of support is outlined as follows:

1-2-1 Support Strategy Office Hours

One Nucleus Gold members will be able to book a 1-2-1 session to discuss what support would be most useful from the list below. Together, the member company and One Nucleus team will develop a support plan, including searching and accessing key data, contacts and expertise from the One Nucleus network that will help that member company’s route to investment.

Sharing Business Intelligence & Contacts Assembled From:

- Publicly available data and One Nucleus internal research

- Subscription only commercial intelligence sources and publications such as PitchBook.

During the Office Hours session, the member will guide One Nucleus through the types of data and direct contacts they would like to assemble, and these will be included in the final report.

Access Expert Advice on Non-Dilutive Funding and Incentives

One Nucleus is blessed to count high-quality expert advisors within our membership on topics including:

- UK and International Grant Funding

- Government incentives for R&D

- Government investor incentives.

Strategic investor and biopartnering conference collaborations

Whilst deals are very often instigated by leads for an investor’s or dealmaker’s own network rather than at pitching or partnering events, a topic I have surveyed and written about previously in the ‘Creating the Home of Champions’ blog, building your brand value through visibility and making the most of the efficiency of bio-partnering events can remain valuable. For this reason, One Nucleus maintains a number of very strong relationships with key third party global partners and have reshaped our own events to provide opportunity, including:

- Informa’s EBD Group and LSX BioEurope Spring and Autumn, Biotech Showcase and LSX Congresses

- Life Science Nation for RESI at JPM Week, Boston, Europe and London

- Free pitching opportunities at One Nucleus events such as Genesis and BioWednesdays.

Knowledge-Sharing and Connectivity to International Clusters

It is somewhat inevitable that growth will lead to at least a degree of internationalisation for many members. That could be to expand a physical footprint, access different pools of capital or indeed to recruit senior staff or engage key opinion leaders. Accepting our members need to think globally, so do One Nucleus, and hence engages in nurturing relationships and contacts who can help our members when the time is right. This includes:

- Initiatives such as the annual Boston Bootcamp

- Hosting of senior inward trade missions

- Participating at international events where such connections are made for us to relay back to our members.

Creating the One Nucleus Lookbook

Evident from recent discussions has been that many trade support groups, often funded by their government to build collaborations, inward investment and awareness of opportunity, are aided in the role to help when they receive a lookbook. This publication takes the form of a directory profiling businesses seeking to connect with investors, partners and clients, which these enablers are able to disseminate to appropriate contacts. Furthermore, connecting to these well-connected operators in key markets also provides an opportunity for feedback on messaging, presentations and market fit as the member company’s plans develop. Where there is demand, One Nucleus will:

- Create a member lookbook tailored to the audience

- Arrange online sessions for feedback on pitches and approaches directly from the target market

- Connect the member company with trusted networkers to aid introductions

Targeting the Right Connections

A frequent piece of feedback we receive, or get asked about, is the challenge of knowing which investors to target when seeking investment. Starting with a very long list is a start, but refining that to know who invests in your technology space, type of company and geography can soon whittle the list down to allow limited resources to be applied effectively. There is no way to replace serendipity or plain good luck in business, but that is hard to control, and you can only narrow the odds by being visible, accessible and known to be thought of positively by your peers.

Whilst, as mentioned above, deal count has been low, nonetheless deals have been happening. If I take a look at the PitchBook data for our local regions, it would tell me 27 deals have happened this year where the top ones included deals by CellCentric, Maxion Therapeutics and NodThera as named below. The smaller deals, represented by smaller deal sizes, cover the remainder. Armed with such information and the ability to interrogate it, companies can ascertain which companies are investing locally at that size ticket and whether they still have money to invest. This is the type of guidance One Nucleus wishes to target to our members in support of their fundraising plans, for example.

Closing Remark

Raising investment is easy, said nobody I have met and certainly not in the past 18-24 months, but targeting our support, pending dedicated ties with member companies to understand their needs and interrogate data such as the above with them and leveraging our relationships and deals with global players, One Nucleus aims to provide the effective support that will see many more deals secured and spent wisely in creating value for all stakeholders.

More information:

Please feel free to get in touch directly with me at [email protected] if you would like to discuss any of the above support.